"InExArbitr" - A program for searching arbitration situations within one exchange

In order to understand whether arbitrage situations arise within one cryptocurrency exchange, you just need to go through all possible combinations and measure their price offers. The “InExArbitr” program does exactly that.

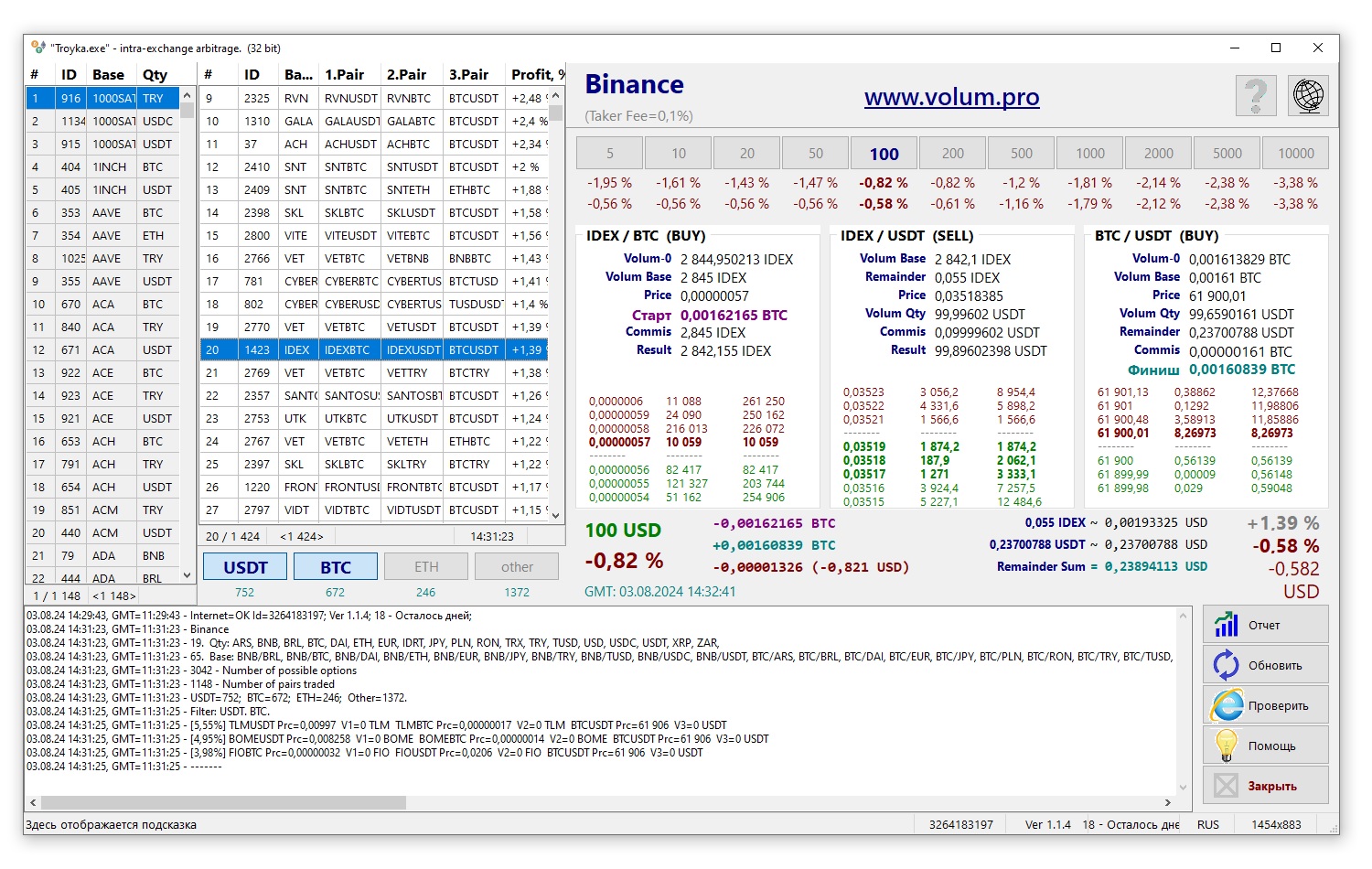

Looking for good combinations for intra-exchange arbitrage

The first thing you need to do is choose a cryptocurrency exchange where you are going to take measurements. Then you need to specify your individual commission on this exchange. The program will automatically collect all the pairs traded on the exchange and then create all sorts of arbitrage combinations from them. During this calculation, the program will also calculate the preliminary theoretical profit for each trading combination. The preliminary calculation will be based on the price of the last transaction for each trading pair. There is a trap here that many beginners fall for. This is only a theoretical profit, which should never be used as a guide when making trading decisions. The only thing that can be deduced from the readings of this theoretical profit is that the real profit will never be better than the theoretical profit, but will only be worse. But more on that later. In the best case, the real profit will be the same as the theoretical profit, but this is also unlikely. What does this give us? And this helps us understand what arbitrage situations we need to pay attention to first of all, and what situations we should not pay any attention to at all. All trading combinations can be sorted by theoretical profit and then from the resulting list, several dozen first combinations can be analyzed in detail. The second table contains all trading combinations. By clicking the mouse in the table on each trading combination, the “InExArbitr” program will make a request to the exchange for all three trading pairs and then, having received a response from the exchange, will calculate the real profit at a given time. The real profit will greatly depend on the volume of the coin launched into circulation. All experienced traders know that the larger the volume of their transaction, the worse the market price. In arbitrage trading within one exchange, there is one important point - there are no limit orders, otherwise it will no longer be arbitrage, but regular trading.

There is no arbitrage within one exchange

As the InExArbitr program clearly shows, there are no real arbitrage situations within one exchange. This can be explained by simple logical thinking. The exchange itself has priority access to current price offer data and also has a priority position in the matter of making a deal. And its servers are more powerful, which means that the exchange reacts to the situation faster. Well, how can the exchange itself not use its huge advantage in order to receive a small but guaranteed income? Then a logical question arises - why do we need this InExArbitr program if it is impossible to earn money on intra-exchange arbitrage with it? Well, firstly, this is a very interesting personal experience in debunking your rosy dreams. Now, every time the thought returns to your head that maybe you can still earn money on intra-exchange arbitrage, you run this program and see that this is not so. Secondly, you can use partial arbitrage instead of full arbitrage, that is, choose a trading combination with a minimum real loss using the “InExArbitr” program and leave the last third transaction in limit orders with a profitable price. The probability of this limit order being triggered will be almost 100%. And even if it does not work, it will not be considered a loss on the spot market. Plus, when compiling arbitrage combinations on the last (third) trading pair, the most liquid coins are always traded, which means that in the worst case scenario we will still be left with a liquid coin in the wallet.

Exposing the crypto bloggers who prove that internal arbitrage exists

You can often find pseudo-specialists in intra-exchange arbitrage on YouTube. They show how they conduct transactions with a tiny profit within one exchange. According to their logic, if there is a profit, then there is arbitrage. Their scam is that between the first and last transaction they have a time interval of approximately one minute or more. During this time, prices, of course, have time to change in any direction. In such conditions, in three or four takes, you can really catch this tiny profit. Of course, these bloggers will modestly remain silent about the unprofitable transactions that occurred when recording their video. The arbitrage situation should be in the moment and not stretched out in time. However, there is another type of crypto bloggers. They recommend placing a limit order on the last transaction. In such conditions, profitable transactions are almost guaranteed. It is hard to disagree with this. The first two transactions are conducted at the market price, and a limit order with a profitable price is placed on the third transaction. Then, indeed, with almost 100% probability, you can get a tiny profit. But this trading method cannot be called pure arbitrage - it will be a combination of arbitrage and trading. What unites these two types of crypto professionals? All of them take as an example not arbitrary arbitrage combinations of trading pairs, but combinations with minimal arbitrage loss. This is exactly what the “InTxArbitr” program does.